Reviewed by Ashley (Brendle) Rey, MBA

Stocks soared in the wake of the 2024 presidential election, but in California, the business community is wringing their hands a bit.

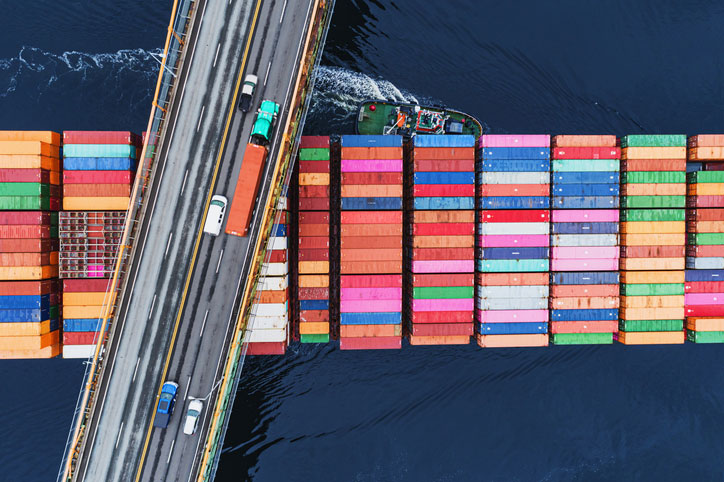

California has repeatedly drawn Trump’s ire, both for opposing him during his first administration and for voting the other direction in his most recent election. While promises of regulatory rollback are music to the ears of many businesspeople, it’s taking a backseat to the one promise that is really ringing alarm bells up and down the West Coast: tariffs of at least 60 percent on Chinese imports, and rates ranging from 25 to 100 percent on Mexican goods.

While tariffs are applied at the national level, it’s no secret that California, with the largest import market in the country, will feel the pain first and foremost.

California Businesses Will Feel the Heat First When Tariffs Get Turned-Up

According to the California Assembly Committee on Jobs, Economic Development, and the Economy, California’s largest source of imports is China, frequently mentioned as target for tariff rates up to 60 percent by Trump. It’s a $146 billion market that goes a long way toward powering the state’s nearly 1 million registered businesses and almost 16 million employees.

It’s not just the import side of business that will be impacted, either. Imposing tariffs on a country almost always spark retaliatory tariffs from those same countries. A half million of those jobs are supported by California exports, each of them paying around 18 percent above the national average. Every one of them are on the line, too.

The non-partisan Tax Foundation compiled estimates based on analyses completed both in-house and by a range of other financial and investing organizations, including Moody’s, UBS, and the IMF, and found impacts on U.S. Gross Domestic Product ranging from around half a point to over three percent in negative growth. That’s more than the 2.6 percent drop that heralded the Great Recession in 2009.

It’s Not Just International Business MBAs in California That are Concerned

For anyone considering an MBA from a California business school, particularly one focused on international trade, this might seem like a big red warning light flashing next to the submit button on your admissions application.

But it actually goes well beyond international business. For starters, it’s likely to depress both the national and state economies overall as consumers and businesses are forced to tighten their belts. Even in the best-case analysis, the jumpstart that tariffs might provide to domestic manufacturers and service providers could take years to appear. That’s a significant delay in any revenue improvements that might theoretically emerge to spend with California companies.

It’s also true that supply chains are so deeply intertwined in the modern world that even businesses that appear to be entirely domestically based often have hidden dependencies on foreign goods. That’s bound to snarl even California businesses that should have bright prospects in a tariff regime.

California Has Some Bright Spots that Will Continue to Shine in a High-Tariff Environment

It’s the business of MBA graduates to navigate through tough tariff terrain in California. And the good news is the state has been blessed with natural resources ranging from rare-earth elements to oil. It’s got a relatively strong high-tech manufacturing sector that is likely to revive as foreign options are priced out. And it’s the number one provider of agricultural goods in the nation—although it remains to be seen what sort of impacts that industry’s workforce will face in the wake of Trump’s massive threatened deportation effort.

The state is also such a juggernaut in both the national and international economy that it may expect some carve-outs and exceptions. For example, Trump isn’t likely to anger cheerleader Elon Musk by throwing Tesla under the bus. It’s also the case that California generates much of the nation’s tax revenues, making it the goose that laid the golden egg. Choking off that income stream won’t leave a lot of funding for programs the administration supports.

A First-Rate Business Education Is Your Best Chance at Adapting to a New Business Environment

If this doesn’t sound like an appealing time or place to earn an MBA with a focus on international trade, there is still reason to show up for class.

Business is all about adapting, and an MBA from a California university is a master-class in adaptation. It’s going to take the sharpest executives to straddle the line between hiking prices and cutting profits to keep the goods flowing to consumers who need them. There will be plenty of California businesses that end up as twisted wreckage beside the tracks after they get hit by the Trump tariff train… the ones that make it through in the nick of time are likely to be those led by the top tier of MBA students graduating in the next few years.

The expertise in negotiation, quantitative analysis, and coordination built into MBA studies is exactly what will help businesses survive the impact of tariffs.

MBAs are also the executives best positioned to engage in the complex work of supply chain analysis that will be necessary to deal with tariffs. Even companies that are theoretically entirely sourcing their supplies from domestic manufacturers need to be concerned if those manufacturers are in some way reliant on foreign goods.

For example, a California lithium battery manufacturer using ore mined in West Virginia might seem on the surface to be in a good position. If the mining company happens to use loaders that only take tires that are made with steel imported from Japan, well, before long it’s going to cost a lot more or grind to a halt.

The tariff regime may closely resemble the supply chain crisis that came in the last Trump term during COVID, where small but unexpected dependencies on foreign goods wreaked havoc in the production of all kinds of American goods.

Tracking down these dependencies is tough work that no one is going to outsource to AI. MBA graduates from California’s top business schools are going to have all the work they can handle if tariffs from the Trump administration actually land. The education they have received could be the difference between the businesses that make it and those that don’t.

Senior Platform Sales Representative – Empowering Higher Ed with Technology for Student Success

-#1 Global Enterprise BDR 172% FY 2022

-100% quota attainment on $2M+ book of business

-SME: Created and led best practice trainings for new BDR/AE/AM cross-collaboration

-Crafted and scaled communication content improving close rate and account engagement (i.e. prospecting videos, email sequences, tutorials, webinars, and BDR sales trainings)

EDUCATION

Seattle University – Master of Business Administration – MBA 2021

University of Washington – Bachelor’s degree Sociology

AREAS OF SPECIALTY

Prospecting | Sales Presentations | CRM software | Value proposition development | Social selling | Coaching | Business communication | Forecasting | Project management | Product knowledge | Client engagement